Table of Content

If you’ve fallen behind on your mortgage and you’re at risk of foreclosure, you can visit the same site for resources for existing homeowners. If you qualify, you can get unemployment mortgage assistance, mortgage reinstatement assistance, principal reduction or transition assistance. You can also potentially lower your monthly payment through the Home Affordable Modification Program. That faster, easy-on-the-lender foreclosure process may sound like a borrower’s nightmare, but it’s worth noting that California is a non-recourse state. Say you take out a mortgage and then your financial circumstances change, leaving you unable to pay back that mortgage debt.

If you have specific questions about the nuances of applying for a mortgage, refinancing or buying a home in California, a mortgage banker or realtor licensed to work in the state can be a great asset. Calexico, CA — Living in Calexico is slightly more expensive than the other cities on this list, but is still well below the cost of living in the rest of the state. Barstow, CA — Barstow, which is halfway between Los Angeles and Vegas, is a small California town with an affordable cost of living. The median value of a home in Barstow is only $107,100 and the median monthly cost of ownership is $1,116. All fixed-rate loan products followed the same trend upward and then downward trend as the 30-year fixed-rate loans.

Jumbo adjustable-rate mortgages

Two of those factors are the median home price and median monthly ownership costs for homes in California, which are significantly higher than the national average across the board. The state also has the 11th highest average cost of homeowner’s insurance, and when it comes to the cost of living, the state ranks as the 2nd most expensive, only after Hawaii. Getting a mortgage in California can be different from shopping for a mortgage in other states.

Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. United States Department of Agriculture loans are for homebuyers in rural and designated USDA areas. Similar to VA loans, USDA loans have no down payment requirements and the credit requirements are looser than conventional mortgages. Rates on 30-year fixed mortgages in Sacramento, California increased to 5.49% this week.

How Will The Boc Rate Affect Home Prices

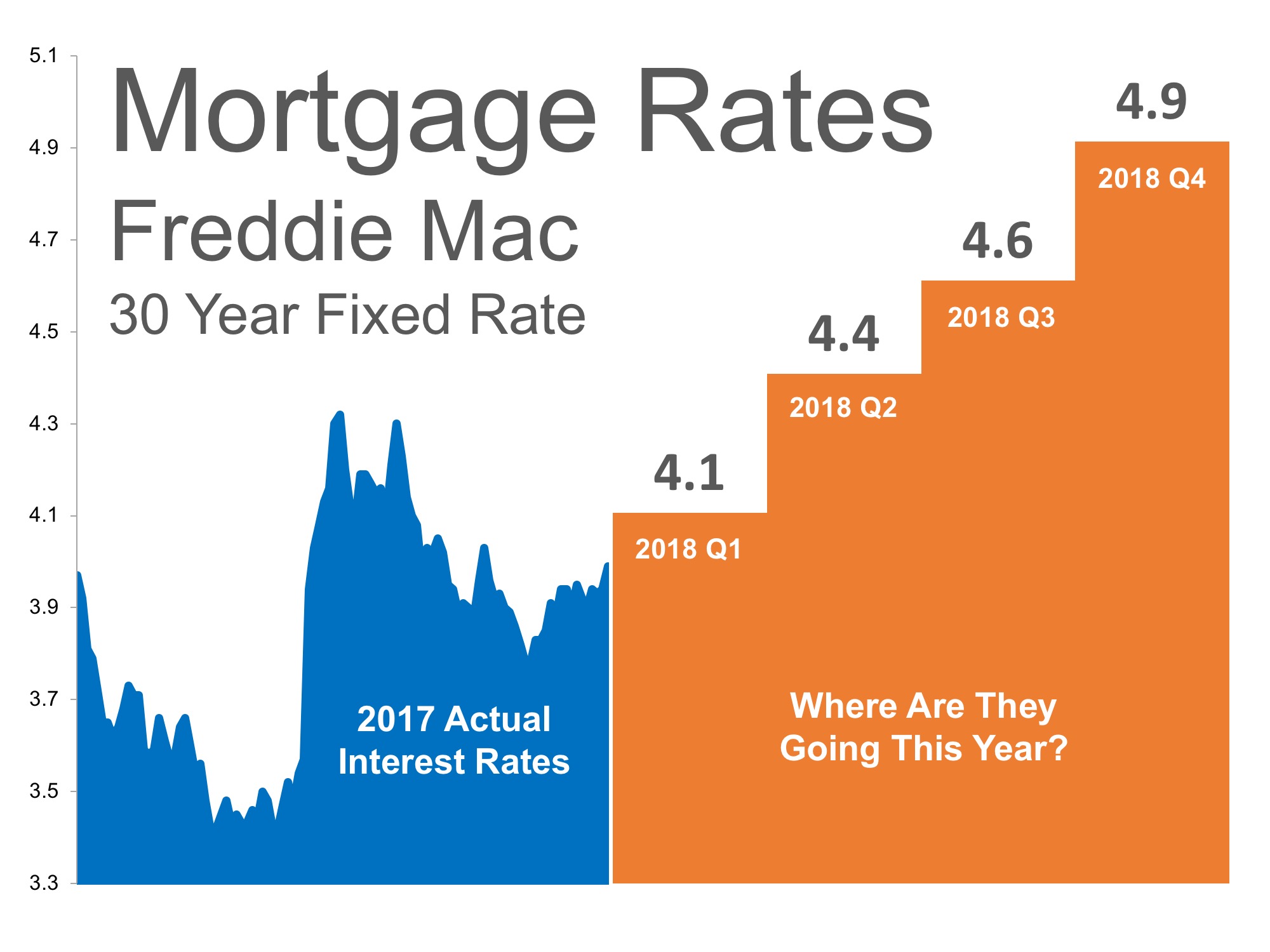

Rates were constant through mid-2018 and then spiked upward at the end of 2018 and the start of 2019. Following the spike, the rates began a slow descent, eventually landing at the lower rates, where they currently sit. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. A number of California counties have conforming loan limits that are higher than the standard $647,200. That long list of counties with higher conforming loan limits gives you an idea of how expensive homes in California are.

Some of these programs include grants, no-interest deferred loans and financial assistance for the construction of accessory dwelling units . Money's Top Picks Best Personal Loans Over 170 hours of research determined the best personal loan lenders. Mortgage rates are currently 6 basis points less than the 5.55% national average rate. We will not sell your personal information but might offer an excellent rate every now and then on various ad platforms. But if you're still uncomfortable, you may opt out by using the link Do not sell my personal information. Mortgage rate locks occur when a lender agrees to cap the borrower’s interest rate while the loan application is being processed.

California state current mortgage rates

Mortgage rates in Colorado are currently 4 basis points less than the 6.19% national average. The table below is updated daily with California refinance rates for the most common types of home loans. Atherton, CA — Housing, grocery and transportation costs in Atherton are all much higher than the national average. Housing is 55% higher than the national average, with a median home price of $537,872 and a median rent of $1,685. Some of the Services involve advice from third parties and third party content.

While California is a beautiful state, many areas within the state are very expensive to buy a home or live in — which is especially true in the coastal areas. Plus, the cost of living in California is high, homeowner’s insurance is high and the home prices in some areas are astronomical. With that said, the current mortgage and refinance rates in California are slightly below the national average. Compare national mortgage rates to see how they stack up against California rates. ARM Loans - Adjustable-rate loans and rates are subject to change during the loan term.

A Brief Introduction to Sacramento, California

You’ll also want to look at tax rates when deciding whether to buy in the state. While the exact rate you’ll pay varies by the county and city you choose to buy in, the effective tax rate for the entire state was 0.74%. El Centro, CA — The median monthly cost of owning a home in El Centro is right on par with the national average, but it’s well below the rest of California.

That means that more California mortgages are "jumbo loans," which are any that exceed the conforming loan limit. This limit is $647,200 in most U.S. counties, though as mentioned above, several California counties have higher conforming loan limits in recognition of the high real estate prices in those areas. If you plan on getting a jumbo loan for your home mortgage, brace yourself for paying a higher interest rate.

With an ARM you generally pay a lower interest rate than you would with a fixed-rate mortgage – at first, anyway. That lower rate prevails for an initial, introductory period that may last for one, three, five, seven or 10 years, depending on the terms of the loan. After that initial period, the mortgage interest rate can “adjust,” which generally means it will rise. The good news is that at the moment refinance rates are still really low, so if you’ve got a mortgage that you’ve had for a while, you should definitely consider refinancing. It’s possible that your current rate is higher than you could get currently.

The main reason and advantages of refinancing are to lower the interest rate and reduce your monthly payment. When the mortgage market is going down, the average interest rate of the market reduces, and that is the best time for refinancing. The loan terms shown above do not include amounts for taxes or insurance premiums. Your monthly payment amount will be greater if taxes and insurance premiums are included. First-time home buyer assistance programs in California and across the U.S. offer loans, grants, down payment assistance and tax credits. Bank mortgage loan officer for more information about programs available in California.

By using the Services, you agree that Interest.com may collect, store, and transfer such information on your behalf, and at your sole request. You agree that your decision to make available any sensitive or confidential information is your sole responsibility and at your sole risk. Interest.com has no control and makes no representations as to the use or disclosure of information provided to third parties. You agree that these third party services are not under Interest.com’s control, and that Interest.com is not responsible for any third party’s use of your information.

Each Advertiser is responsible for the accuracy and availability of its own advertised terms. Bankrate cannot guaranty the accuracy or availability of any loan term shown above. As of Tuesday, December 20, 2022, current rates in California are 6.63% for a 30-year fixed and 6.02% for a 15-year fixed. Conventional mortgages are loans that conform to Fannie Mae and Freddie Mac underwriting standards. These are the most common mortgages that are not backed by the government.

How to find the best mortgage rate in California for you

Before committing to an ARM it’s a good idea to calculate whether you could afford to pay the maximum interest rate allowed under the proposed loan terms. We’re guessing you wouldn’t want to be stuck with unaffordable monthly payments after your mortgage rate adjusts. Mortgage refinancing is a good option for lowering mortgage costs. The borrower can get the several benefits of refinancing if he knows the right time of refinancing.

No comments:

Post a Comment